Why cash is still king – and growing in power

DEC.

You might be forgiven for thinking that cash is facing a reduced role in the

economy of the future. New technologies such as Bitcoin and other

cryptocurrencies are snapping at the heel of the established system.

Governments want to push down the role that cash plays in criminal acts,

further demonising the humble cotton note.

Yet, despite all these pressures, cash is actually being used in more ways

than ever.

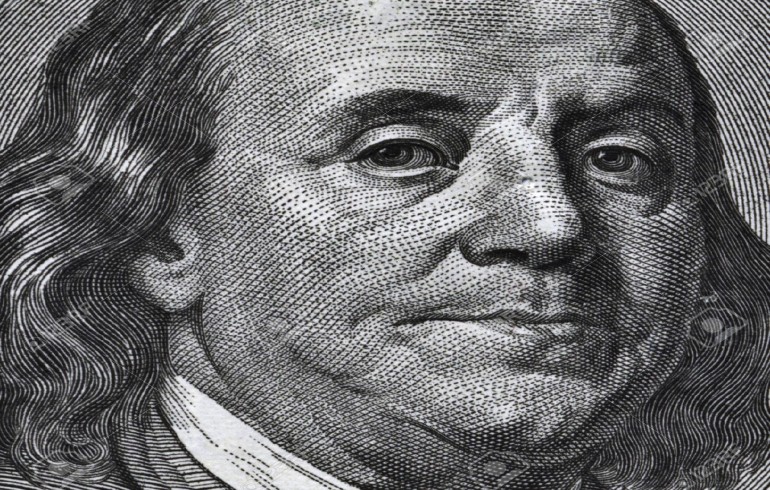

The Federal Reserve recently released figures that highlighted the rise of

dollar bills in the American economy. Back in 2010, notes in circulation made

up 6% of GDP – this increased rapidly to 9% by 2018, mainly driven by the use

of the $100 bill.

In 2005, the $100 bill sat well behind the $1 and $20 notes in terms of overall

value. Yet at the turn of this year it shot above all other denominations.

Why has this happened? Economists believed that the financial crash in 2008

and the resulting uncertainty that spread throughout the following years has

given cash the ultimate insurance status.

What’s the best way to store cash? In the highest possible bill of course.

Hence, you may not actually see many $100 bills when you’re out shopping – they’re

far more likely to be stashed away under millions of American mattresses.

The hoarding is not just confined to the US. The Federal Reserve believes

that people across the world are hiding dollars as a hedge should their local

currency dive.

One thing’s for certain - you’ll be happy if you’re a fan Benjamin Franklin

because he’s never been so popular.